The NZ economy has been on a serial decline for years. A rare window of opportunity of being able to do something about it is beginning to close. There is multi-party support for radical change to the tax system, the findings of the multi-partisan Tax Working Group recommended a radical tax system overhaul, and the Prime Minister (the first one in a long long time) comes from a global financial markets career and understands the problem as well as anyone. Moreover, the PM has had the populist political capital and the cover of the GFC (Global Financial Crisis) to instigate and execute change. He has failed on all counts and decided to do next to nothing. Now he's either lacking the balls, or is playing a smart long game and intends to execute a more elaborate plan in his second term. After all, perhaps he figures that the lowest common denominator voting public need some warm-up time to be educated around to such a big change? Time will tell. . .

Two things will save NZ's economic prosperity if anything is going to. One, a structural shift from private investment in non-productive asset classes (like domestic housing) to productive asset classes. Correcting the skewed incentives in a messy tax system is the easiest way to do this. Two, the further engendering of innovation and a commercial platform to monetise and scale it. Creating juicy tax breaks for different types of early stage venture investors is both an easy and high-octane solution.

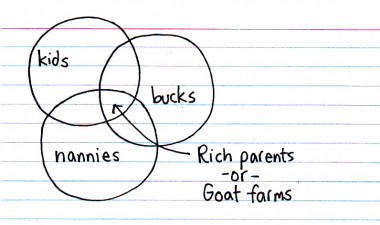

IdeaLog (where I ripped the above graphic from) have a

very readable article explaining what a mess NZ has managed to create and how to sort it out. Well worth reading.

John Key (NZ's current PM) postured himself as the new hope and the man to drive change after 9 consecutive years of

Helengrad and the gross ineptitude of Michael Cullen her Finance Minister. He can still deliver. Time is running out, both for him and NZ's economy.