I've had a busy few weeks - hence the lack of posts. Posting is likely to be intermittent for the next while. . .

Meanwhile. . . Another good doco/ interview from VPRO Backlight. All about quants, the role they play, and their part in the GFC. Good viewing:

Monday, May 17, 2010

Monday, April 26, 2010

Late Monday Tunes. . .

Neil Young - Old Man

. . . And for some reason this reminded me of Alice In Chains' Rooster

The Cure and Korn, unplugged, live mash up - Make Me Bad & Inbetween Days

Alice In Chains - Rooster

Wednesday, April 21, 2010

Monday, April 19, 2010

Friday, April 16, 2010

Friday Tunes

Matt Costa - Sunshine

And here's another. . . because it's Friday

The Offspring - Self Esteem

Monday, April 12, 2010

To Pay or Not To Pay ?

Some very good points made over at Shirky's blog about consumer (non)payment of media. Will be interesting how the battle between the to pay and not to pay camps (Godin vs. Murdoch) plays out. Maybe even Freemium will prevail?

Worth a read, here. Here's a taste:

Bureaucracies temporarily suspend the Second Law of Thermodynamics. In a bureaucracy, it’s easier to make a process more complex than to make it simpler, and easier to create a new burden than kill an old one. . .

When ecosystems change and inflexible institutions collapse, their members disperse, abandoning old beliefs, trying new things, making their living in different ways than they used to. It’s easy to see the ways in which collapse to simplicity wrecks the glories of old. But there is one compensating advantage for the people who escape the old system: when the ecosystem stops rewarding complexity, it is the people who figure out how to work simply in the present, rather than the people who mastered the complexities of the past, who get to say what happens in the future.

This ties in nicely with the ongoing debate about the tabehoodai (all-you-can-eat) media plans raging over the web. Looks like supply-side sentiment is crystallising into action with the tariff shifts against the consumer.

Thursday, April 1, 2010

Living in the End Times

Now who said being nuts and being intelligent were mutually exclusive? Here's a fascinating vid of well-known Slovenian philosopher Slavoj Zizek giving his $0.05 worth on a bunch of different current global circumstances. Now clearly this guy's more than a bit of a raving lefty, but interesting nonetheless. Moreover, the structure of the 'interview' is pretty cool. Curious how such a pinko has praise for the benevolent dictatorship of Singapore and their particular flavour of capitalism. I'm sure that communism is largely retired to the trash heap (where it belongs), but the new wave of British 'Red Tories' might turn out to have some staying power as pointed out in this Prospect Magazine article [HT MGJ].

NB: I found the second 'story' of the girl and her family bank and how the market were tripping over themselves to buy the bank and the quality assets on its balance sheet particularly interesting - I'm working on a mandate for a new EU bank desperate to buy prime conforming mortgage books (not RMBS or CMBS). This market is unbelievably hot with every first and second tier credit institution falling over themselves to buy this stuff and shore up their balance sheets, or at worst, hold on to the stuff they've got already. Then you've got the lawyers trying to sell you advice on forward-flow and innovative origination structures. . . The days of these banks taking a haircut on selling prime assets are well and truly over - if you want to play, you pay par.

Youtube page for bigger, high-res viewing here.

Wednesday, March 24, 2010

Another Mid-Week Tune

So I get asked last night "WTF is Perry Farrell?". . Anna, where were you in the early nineties?? Don't worry if you can't remember, Perry can't either. . . I'm guessing it was the late nineties (as a Fresher) that your memory problems began. So this is for you Anna - Perry is the guy with the mic (and yup, that's Dave Navarro on the acoustic guitar):

Jane's Addiction - Jane Says

Tuesday, March 23, 2010

Monday, March 22, 2010

Evolution

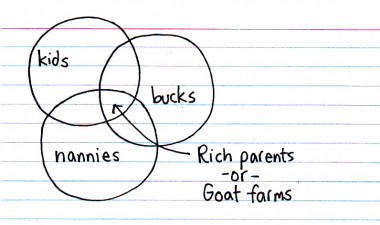

Graphic from Made by Mammals by Andy Marlow. Graphic reposted from Sam Harris' Project Reason.

Update: Sam Harris has an excellent talk here at TED.

Sunday, March 14, 2010

The Message

A reader sent me a link to a short talk by Gary Vaynerchuk filmed in SEP 2008. It's all very Web 2.0 - which isn't so surprising considering it was filmed at the peak of the Web 2.0 hype and that he was speaking at the Web 2.0 Expo. . . North American readers will probably recognise Vaynerchuk as the Wine Library guy - that's who he is.

Anyway Vaynerchuk's fairly amusing and has some good stuff to say (in a Web 2.0 sort of way). He talks about:

Anyway Vaynerchuk's fairly amusing and has some good stuff to say (in a Web 2.0 sort of way). He talks about:

- Building brand equity;

- Do what you love (a la Guy Kawasaki);

- Legacy is greater than currency;

- And perhaps most importantly: It's all about the hustle.

Labels:

Building Brand Equity,

Gary Vanerchuk,

The Hustle,

Web 2.0

Thursday, March 11, 2010

The Trouble with New Zealand: Part II

Last year I wrote about the fundamental problems with the NZ economy in the brief post The Trouble with New Zealand (incidentally this blog's most read). And also in another post A New Tax System for New Zealand.

The NZ economy has been on a serial decline for years. A rare window of opportunity of being able to do something about it is beginning to close. There is multi-party support for radical change to the tax system, the findings of the multi-partisan Tax Working Group recommended a radical tax system overhaul, and the Prime Minister (the first one in a long long time) comes from a global financial markets career and understands the problem as well as anyone. Moreover, the PM has had the populist political capital and the cover of the GFC (Global Financial Crisis) to instigate and execute change. He has failed on all counts and decided to do next to nothing. Now he's either lacking the balls, or is playing a smart long game and intends to execute a more elaborate plan in his second term. After all, perhaps he figures that the lowest common denominator voting public need some warm-up time to be educated around to such a big change? Time will tell. . .

Two things will save NZ's economic prosperity if anything is going to. One, a structural shift from private investment in non-productive asset classes (like domestic housing) to productive asset classes. Correcting the skewed incentives in a messy tax system is the easiest way to do this. Two, the further engendering of innovation and a commercial platform to monetise and scale it. Creating juicy tax breaks for different types of early stage venture investors is both an easy and high-octane solution.

IdeaLog (where I ripped the above graphic from) have a very readable article explaining what a mess NZ has managed to create and how to sort it out. Well worth reading.

Wednesday, March 10, 2010

Betting on the Blind Side

The story of John Paulson is well known. Paulson's hedge fund took a massive short position on US subprime before the wave of defaults began.

But Paulson might just have been beaten to the post by a formerly little-known MD with Asperger's syndrome turned fund manager from Cupertino, CA. Not in the absolute size of the return, but by time. About a year before Paulson placed his bets, Michael Burry had beaten him to it.

There's a great article here in Vanity Fair on how he did it and how he reckons he couldn't have done it without his Asperger's to help him.

Subscribe to:

Posts (Atom)